In the sprawling urban landscapes of Indian metros, Housing Societies are often viewed as the dream template for city living. But these mini cities within cities have a silent drain on their treasury: the common area electricity bill. Between the elevators that never stop, the water pumps that fight gravity, and the streetlights that guard the night, a typical Housing society in Delhi can consume anywhere from 10,000 to 50,000 units of electricity per month (depending on the number and size of homes in the society).

(Note: An electrified household in Delhi consumes about 250-270 units or kWh of electricity per month on average. This is more than in other cities – Chandigarh: 208 units; Ahmedabad: 160 units; and Mumbai: 110 units – mostly due to high ownership of air-conditioners and appliances, as well as tariff subsidies in Delhi.)

Across India, there are approximately 200,000 housing societies (National Cooperative Database, 2024). These societies house millions of households and often pay between ₹10 to 30 lakh every year just for electricity that comes under the Common Area Maintenance Charges (Lifts, common lights, EV charging points, security lights, etc.).

Which makes solar power much more than a symbolic “green” gesture for RWAs. Going solar is easily a sound financial infrastructure decision that RWAs and GHS office bearers must seriously consider.

By installing a Rooftop Solar (RTS) system, an RWA can reduce its common area electricity expenses by 70% to 90%. This effectively converts a high recurring maintenance cost into a fixed, long-term asset that provides free energy for 25 years.

To show the impact of solar, we did a mock case study to show how a high-rise multi-storied colony can use and benefit from rooftop solar installation.

We took the standard monthly bill of an apartment complex in IP Extension, New Delhi.

As per our calculations, the apartment complex could benefit from a Solar plant of 20.23 kWp capacity. These would be in the form of 34 solar modules and would generate 27,340 kWh (units) every year.

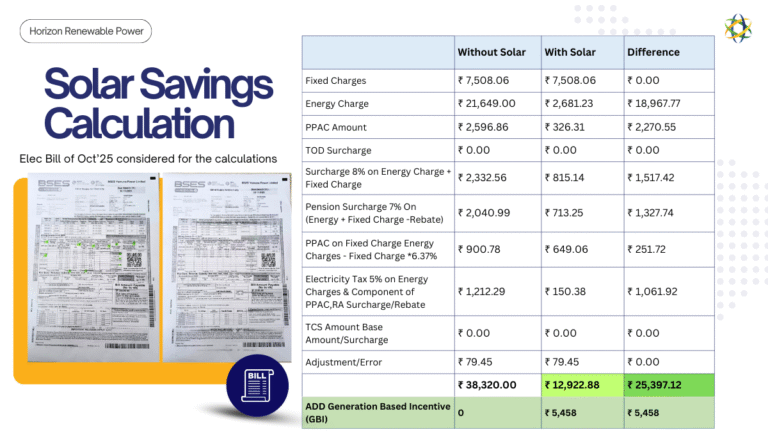

Considering the electricity bill for the month of Oct’ 2025, we could show an immediate reduction in the bill.

The RWA paid ₹ 38,320, and with the suggested solar plant, the bill could go down to ₹ 12,923 – a clear reduction of ₹ 25,397. With Delhi-only GBI (generation-based incentives), the society could pocket an additional ₹ 5,458 every month!

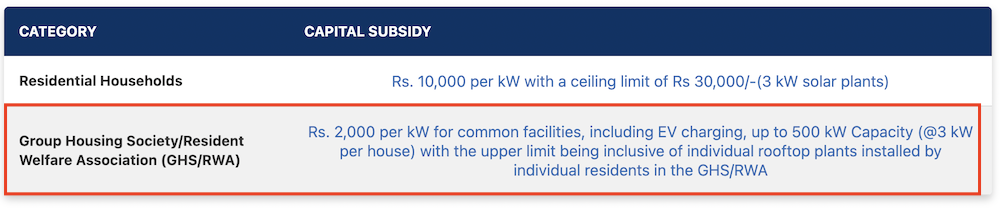

Apart from the obvious long-term financial savings, there are two added incentives for RWAs and GHSs to go solar.

Under the PM Surya Ghar: Muft Bijli Yojana, the financial barriers have crumbled:

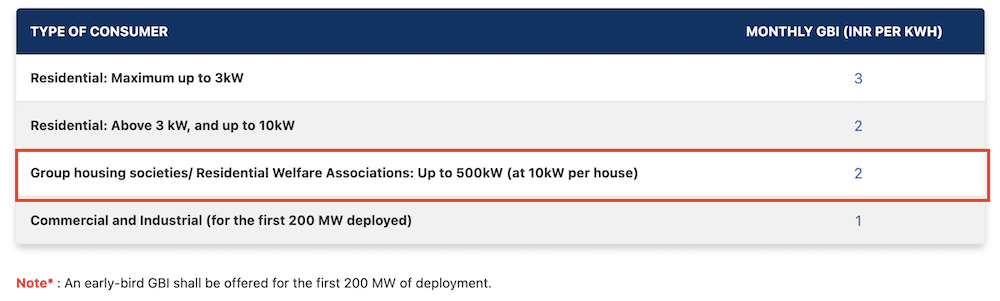

Delhi’s policy is particularly aggressive with its GBI. For RWAs, the government offers ₹2 per unit (kWh) of solar energy generated. This is “extra” income that directly offsets the remaining grid costs or goes into the society’s corpus fund.

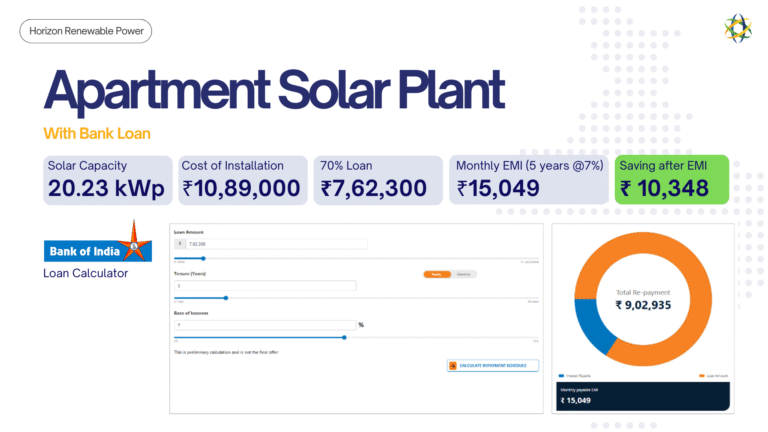

Many RWAs hesitate due to the upfront “Capex” (Capital Expenditure). However, banks like have introduced specialized solar loans offering up to 90% of the project cost as a loan. Often linked to the repo rate, these are some of the lowest interest personal/professional loans available (starting as low as 5.75% to 9% depending on the scheme).

The Result: The society pays the EMI using the money they would have paid to the DISCOM. It’s essentially a “self-paying” asset.

Let’s go back to the IP Extension case study we discussed earlier:

The apartment solar plant of 20.23 kWp:

This still does not factor in ₹ 5,458 that the society will earn from GBI every month!

Under the BOI’s Star Rooftop Solar Panel Finance Loan, RWAs and GHSs have the following benefits:

Source: https://bankofindia.bank.in/personal-loan/star-rooftop-solar-panel-finance-loan

Net Metering: Net metering is the backbone of solar economics. It uses a bi-directional meter that tracks energy taken from the grid vs. energy fed back. You do not need expensive physical batteries. Net Metering uses a bi-directional meter to track solar energy exported to the grid during the day and grid energy imported at night. You only pay for the “net” difference.

Maximizing Roof Utility: Elevated Structures: The most common concern is: “Where will the residents dry clothes or walk?” The answer is Elevated Structures. Instead of mounting panels flat on the roof, they are placed on 8–10 foot high iron pillars. This creates a “Solar Rooftop Canopy,” keeping the floor space 100% usable for residents while providing shade.

Maintenance: The 5-Year Guarantee: The Government of India mandates that the empanelled vendor provide 5 years of comprehensive maintenance (AMC). This ensures that the RWA isn’t left in the lurch. However, societies should ensure a basic cleaning schedule (fortnightly) is maintained to prevent “soiling loss” (dust blocking the sun).

Documentation Checklist for Bank Loans & Net Metering: To move from “thinking” to “installing,” the RWA committee should have these ready:

Going solar for an RWA isn’t just about installing panels. It’s a 25-year infrastructure decision that needs careful planning, sound engineering, regulatory clarity, and long-term support. This is where Horizon steps in, not as a supplier, but as a solar partner for your society.

If your society is considering ways to reduce electricity costs and plan for the long term, solar is a conversation worth having.

Reach out to Horizon to understand what going solar could look like for your society. Call us at +91 9811121157 | 84482 95965

A single discussion today could unlock decades of savings for your community.

Standard rooftop solar systems are grid-tied, which means they work only when the power grid is active. During a power cut, these systems shut down for safety reasons unless you’ve opted for a hybrid solar system with battery backup.

At night, since solar panels need sunlight to generate electricity, they don’t produce power. However, net metering ensures that the excess solar energy you export during the day offsets your nighttime usage, keeping your electricity bill low.

As a rule of thumb, a 1 kW system requires around 80–100 sq. ft. of shadow-free roof area. For a typical home with a monthly bill of ₹2,000–₹3,000, a 3–5 kW system is usually sufficient, which needs 300–500 sq. ft. of usable roof space.

Flat concrete rooftops are ideal, but we can also work with sloped roofs or terrace railings using customized mounting structures.

The cost depends on the system size and whether you're opting for battery backup. For most homes, a 3 kW system without batteries may cost around ₹1.5–2 lakh after subsidies.

Thanks to the PM Surya Ghar scheme, residential customers are eligible for up to 40% subsidy, and we help you handle all paperwork for availing this benefit. Financing and EMI options are also available.

Solar systems are low maintenance. As a homeowner, you just need to clean the panels every 15–30 days with water and a soft cloth to remove dust and bird droppings.

We recommend annual inspections to check wiring, inverter health, and performance. If you prefer, we also offer Annual Maintenance Contracts (AMCs) so you don’t have to worry about upkeep at all.

At Horizon Renewable Power, our mission is to transform India’s rooftops into efficient, self-sustaining energy hubs. We aim to make solar energy affordable and accessible to a wide range of residential, commercial, and industrial customers through two models — EPC (Engineering, Procurement, and Construction) and RESCO (Renewable Energy Service Company).

Our three-year goal is ambitious yet achievable: to commission 1,000 MW of rooftop solar capacity across India. This expansion not only supports India’s clean energy ambitions but also drives significant environmental and economic impact across the communities we serve.

Installing a solar rooftop system brings a host of advantages. First and foremost, it offers substantial reductions in electricity costs, with savings of up to 60% on energy bills. Solar panels also allow homeowners and businesses to make productive use of idle roof spaces by converting them into power generators.

Beyond financial savings, solar power contributes meaningfully to the environment by reducing carbon emissions—each unit of solar electricity generated can prevent around 0.8 kg of CO₂ emissions. Additionally, solar energy systems help properties achieve sustainability certifications and net-zero targets while enhancing the visual appeal of the building with modern, sleek panel designs.

Our installation process is thorough, seamless, and professionally managed. It begins with a detailed site survey to assess the roof’s condition, orientation, shading, and load capacity. Following this, our engineers design a customized solar solution based on your specific needs.

We then handle all regulatory permissions and approvals required by local authorities. The installation itself involves setting up strong mounting structures, precision-aligning the solar panels, completing electrical cabling, and integrating inverters and safety devices. Once installed, the system undergoes a series of performance tests and inspections to ensure optimum output before the final commissioning and handover. We also guide you through setting up remote monitoring for real-time tracking

While solar panels may look similar on the surface, the difference lies in quality, design, and execution. At Horizon Renewable Power, we strictly use high-efficiency mono PERC and bifacial solar modules that guarantee higher energy yield. Our inverters and cables are sourced from top-tier global manufacturers, ensuring greater system reliability.

Moreover, our deep design and engineering expertise allow us to create solar systems that blend functionality with aesthetics, adapting installations to local climatic and architectural conditions. Above all, we strictly adhere to MNRE and BIS guidelines, ensuring that every project stands the test of time both technically and legally.

We cater to three major customer segments:

Each segment is served by dedicated teams with specialized technical knowledge to ensure tailored, high-performance solutions.

We offer two flexible financing models:

Both models are backed by thorough maintenance and support services, ensuring complete peace of mind.

Yes, particularly for residential customers. The PM Surya Ghar Yojana and other MNRE-led schemes provide significant capital subsidies of up to 40% on rooftop solar systems for homes.

Commercial and industrial customers, while typically ineligible for direct subsidies, can benefit from tax advantages and accelerated depreciation on solar assets.

Horizon assists all eligible customers in completing subsidy documentation and navigating the often tedious government application process, making the transition to solar smooth and hassle-free.

The financial benefits of solar power are both immediate and long-term. With an EPC model, customers can expect a payback period of 3–5 years depending on their location, energy tariff, and system size.

For RESCO clients, the advantage is immediate — there’s no capital investment required, and savings begin from the first electricity bill post-installation.

Over the system’s 25-year life, customers enjoy locked-in electricity rates, protection against rising energy costs, and significant cumulative savings that greatly outperform traditional investments.

Our rooftop solar systems are built to last.

Absolutely. Customer support is a critical part of our commitment.

Every installation includes access to real-time system monitoring, allowing customers to track generation, savings, and performance from their smartphones or computers.

Our dedicated operations team handles proactive maintenance, warranty claims, and system optimizations. Whether you choose EPC or RESCO, you can expect full after-sales service, 24x7 support, and scheduled site visits to ensure your solar system operates at peak efficiency

Net metering is a mechanism that allows you to feed excess solar electricity back into the grid. In return, your utility company credits you for the surplus, which offsets your electricity consumption during times when your panels aren’t producing enough (like nighttime).

This results in lower electricity bills and maximizes the return on your investment.

From an environmental perspective, every kilowatt-hour (kWh) generated by your solar rooftop reduces about 0.8 kg of carbon dioxide emissions. By switching to solar, you contribute significantly toward combating climate change and moving India closer to its green energy targets.

Customers often worry about issues like technology reliability, maintenance obligations, upfront costs, and long-term savings.

Our goal is to ensure that transitioning to solar is not just a wise financial decision, but also a smooth, trusted, and rewarding experience.